How Covid-19 has 'activated' the digital transformation business

From the topic of trends and forecast in conference rooms, digital transformation into "handshakes", real projects this year.

Lượt xem

The pandemic rattled financial markets, pushed dozens of economies into recession, but helped technology firms have a flourishing year.

1. Fed lowered interest rates urgently to save the US economy

In early March, the US Federal Reserve (Fed) suddenly announced to lower the reference interest rate to around 1-1.25%. This was a long-anticipated move, but the Fed didn't wait until its policy session two weeks later to do so.

Chairman of the US Federal Reserve Jerome Powell at a press conference in March. Photo: AP

The pandemic then spread to the US, but the impact was still minimal. However, the Fed acted immediately, as this was the only way to reassure investors that they were not ignoring the risks from Covid-19. Just before that, US stocks had the worst week since 2008. The Fed itself felt it was urgent to prevent the global economy from falling into recession.

Less than 2 weeks later, they continued to lower interest rates to 0% - 0.25% - the lowest level since 2015. The Fed also committed to buy more government bonds, announced a series of other stimulus measures to maintain credit flows and US dollars. These rates have remained the same and are likely to remain until 2023. Over the past several months, Fed Chairman Jerome Powell has regularly warned of the medium-term US economic outlook and urged the government to increase stimulus finance to speed up the recovery momentum.

2. A series of economies fell into recession

Despite the unprecedented easing policy launched to save the economy, from the beginning of the year a series of gloomy forecasts about the global outlook before the Covid-19 shock appeared. Germany, Italy, and Japan have grown slowly before the pandemic. South Korea is vulnerable due to its dependence on trade. Hong Kong has been in recession since last year. Indonesia's GDP growth in the fourth quarter of 2019 hit the bottom three years. The epidemic will make those problems worse.

Pedestrians on a street deserted by the pandemic in Massachusetts. Photo: Reuters

This concern has come true. The shutdown of the economy to prevent the pandemic from spreading has pushed dozens of countries into recession this year, such as Germany, Japan, America, Singapore, South Korea, UK, Australia, India ... Two-digit GDP has even become commonplace. US GDP dropped a record 31.4% in the second quarter (adjusted on an annual basis), while UK GDP decreased by 20.4% q-o-q.

However, in the third quarter, the economies began to recover, at a faster rate than expected. The reason is that the degradation nature does not stem from the problem of structure and stimulus policies of the countries gradually taking effect.

3. In US stocks, gold price continuously peaked

Earlier this year, Wall Street continuously set a record thanks to the US - China signing the phase 1 trade agreement and China gradually controlled the epidemic. However, the upturn momentum has suddenly reversed since the end of February, when Covid-19 began to appear in the US. The panic of investors caused US stocks to record the strongest losing sessions of 10, 30 and 40 years in March. All three major indices sometimes lost more than 12% in just one session.

Movements of the US S&P 500 index this year.

The world spot gold price in March also continuously went down, losing nearly $ 200 an ounce. Falling prices as investors sell gold to deposit money for other assets are also plunging.

However, both Wall Street and Gold then had a spectacular comeback. Wall Street only took 5 months to go from bottom to new peak, establishing the shortest down-price market in US stock history. The market goes up for many reasons, from technology stocks favored in the pandemic, the impact of the record stimulus package, predicting Joe Biden's election to expectations for the Covid-19 vaccine.

Gold prices in August also set a new peak, when it was over $ 2,000 an ounce, thanks to the expectation that US officials will increase monetary stimulus in the context of high cases of infections. The price then decreased slightly, now to less than 1,900 USD, due to the information about the vaccine and the political instability of the US to calm down.

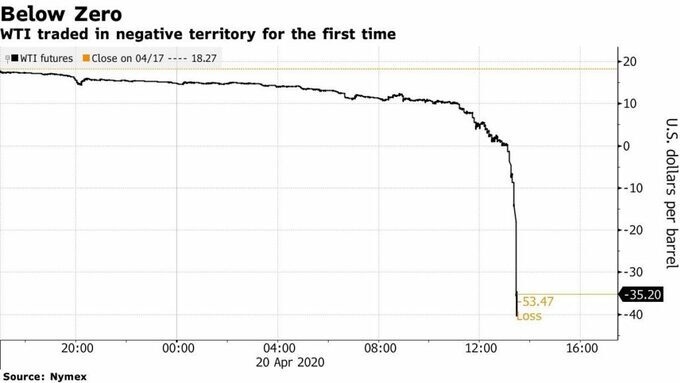

4. Crude oil price dropped to negative for the first time

Crude oil is also a victim of Covid-19. Earlier this year, prices plummeted due to double effects from both supply and demand shocks. Fuel demand plunged because of the pandemic, while supply increased again after OPEC and Russia failed to negotiate to reduce production in early March. In total, in the first 3 months of the year, Brent depreciated by more than 65%. WTI lost more than 66% - worst in history.

The decline continued to last into April, despite OPEC's agreement to reduce oil production to a record. Part of the reason is that the WTI contract delivered in May is about to expire, causing this oil to continuously depreciate in the last days.

WTI oil price movements delivered in May, session 20/4. Chart: Bloomberg

The peak was on April 20, WTI delivered in May down to negative $ 37.63 a barrel - the first time in history to drop below zero. losses and oil producers are willing to pay to push crude away. Prices then rebounded as the market switched to new WTI contracts and global fuel demand recovered as countries gradually removed blockade orders.

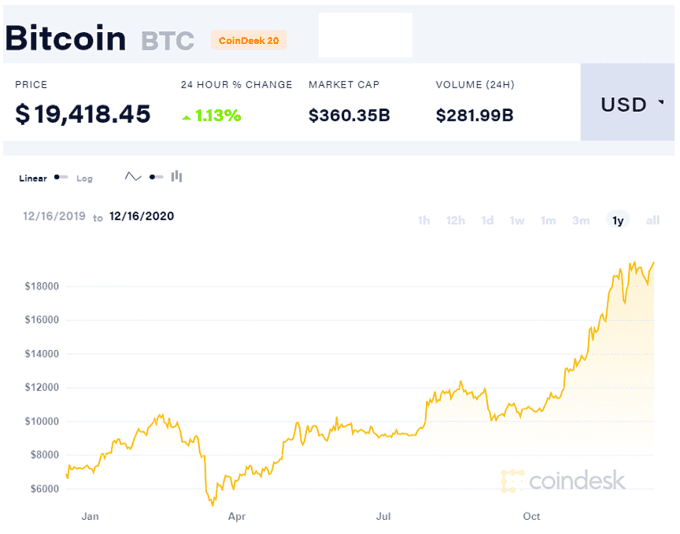

5. Bitcoin to the highest of all time

Bitcoin has nearly tripled this year.

The world's most popular cryptocurrency had a remarkable year, with a 170% increase. Bitcoin started the year with a fake $ 7,000, but is now above $ 19,000. Last month, prices hit $ 19,920 - exceeding the old peak of 2017.

Bitcoin's skyrocketing momentum started around October, reminiscent of the 2017 bubble. However, many analysts point out that this year's developments have many differences. That is the regulation of virtual currency management in many countries is clearer, Bitcoin is more applied in traditional finance, institutional investors and famous billionaires are increasingly interested in cryptocurrencies and potential. prevent inflation when countries launch huge stimulus during the pandemic. Many even think that Bitcoin can replace gold as a haven.

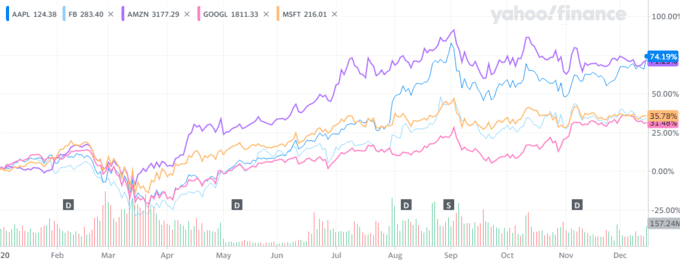

6. The sublimation of technology firms

This year, technology stocks are the bright spot of the market, leading the impressive rally of US stocks after hitting bottom in March. Investors expect high revenue and profit growth in this industry Due to the pandemic, the trend of remote work, online shopping - entertainment and the need for cloud computing has been spurred.

The rise of shares of US technology giants this year.

In the third quarter, revenue and profits of Apple, Amazon, and Alphabet all exceeded forecasts, with double-digit gains. Facebook recorded an increase of 2.74 billion active monthly users.

The skyrocketing shares helped the capitalization of Apple, Alphabet, Microsoft and Amazon exceed $ 1 trillion. Apple was also the first company to have a market value of over $ 2 trillion. Shares of Netflix, Tesla, Square, PayPal, Nvidia and Adobe all peaked this year. Other stocks that benefited greatly from the blockade, such as Zoom Video or Slack, also increased sharply.

7. The US tightens control of Chinese technology giants

Last year, the tech tensions between the US and China mainly revolved around Huawei Technologies. But this year, the US has acted aggressively with more Chinese businesses.

TikTok short video application on a smartphone a user in the US. Photo: Bloomberg

In early August, amid rising tensions between the two countries over many issues, from Hong Kong to the pandemic, US President Donald Trump signed a decree banning US companies from trading with TikTok, WeChat and their parent company. This app is ByteDance, Tencent for national security reasons. The restraining order goes into effect after 45 days.

A week later, he continued to sign a separate decree for ByteDance, requiring the company to separate its US business after 90 days. Under pressure from the Trump administration, ByteDance then reached an agreement with Oracle and Walmart to transfer the US business. Although Trump expressed support for this deal, the Commission on Foreign Investment in the US (CIFUS) has not officially approved. The US government several times later renewed the ban with TikTok, also failed to implement the decree forcing US TikTok to sell itself, leaving the future of this application in the US still suspended.

On December 3, the US added China's largest chip company, SMIC, to a blacklist of businesses owned or controlled by the Chinese military. Previously, Ant Group was also said to be on the target because the US was concerned that the payment company would provide important personal data of US users to the Chinese government.

Hà Thu - VNEXPRESS

From the topic of trends and forecast in conference rooms, digital transformation into "handshakes", real projects this year.

The total warehouse supply in 4 southern provinces soared to over 3 million m2, the North also grew with more than 880,000 m2 of logistics.

Instead of the number of 100,000 Vietnamese sellers on Amazon as previously reported, this floor has just corrected the exact number of only a few thousand.